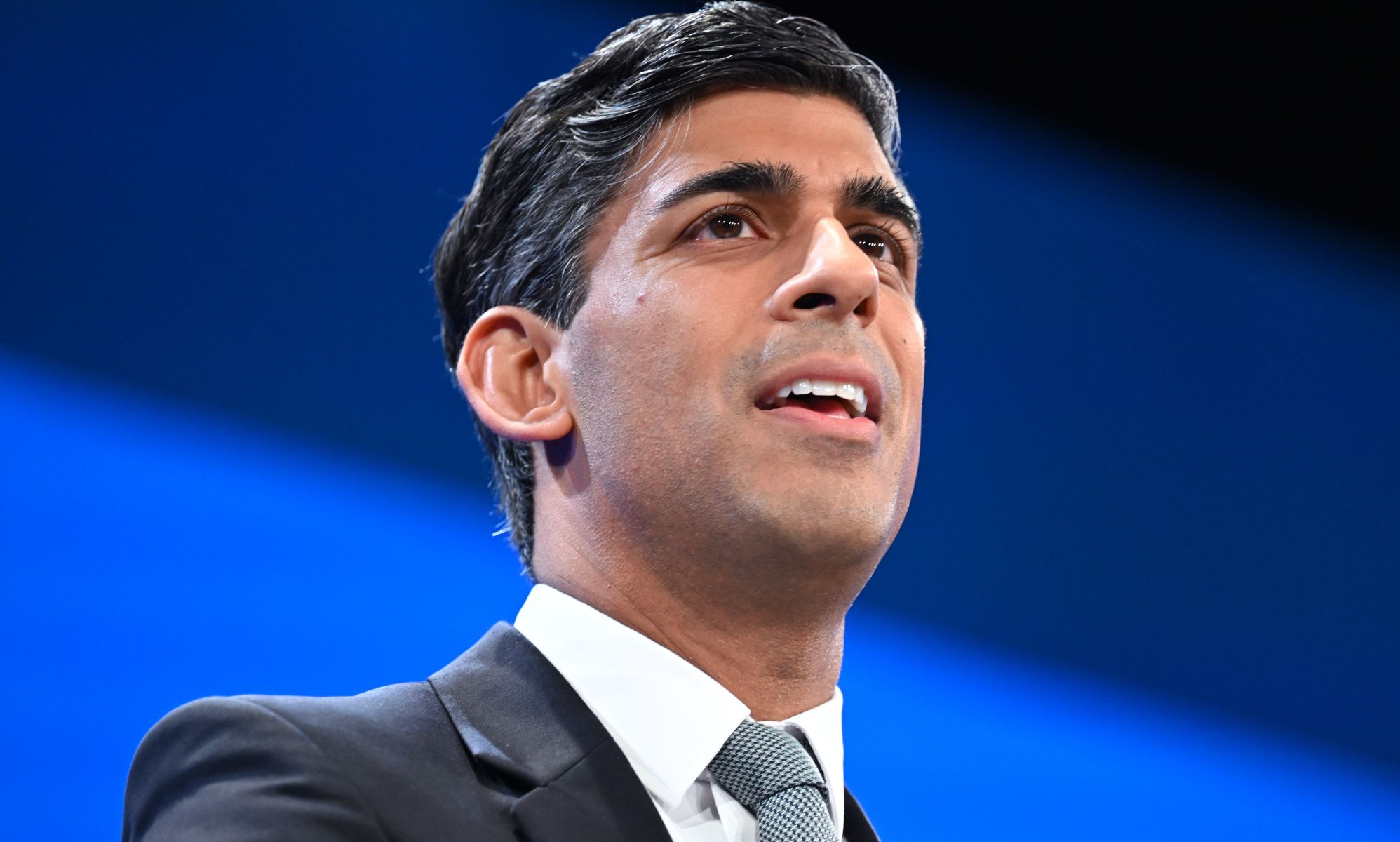

Rishi Sunak has been widely criticised. (Getty)

UK Prime Minister Rishi Sunak has come under intense scrutiny over tax after it was revealed he paid half a million pounds in UK taxes last year, a rate of just 23%, despite his total income soaring to over £2 million.

Details released by Downing Street showcased Sunak’s tax bill of £508,308 for the financial year 2022/23. The bulk of his income, £1.8 million, was attributed to capital gains, a figure that had surged from the previous year. He also pocketed £293,407 from other interest and dividends, and earned £139,477 from his MP and prime ministerial salaries, a sum that made up just 6% of his total income.

Critics wasted no time highlighting the stark contrast between Sunak’s tax rate and that of the average worker. Despite raking in millions, he paid an effective tax rate similar to that of a teacher, with only about 23% of his annual income subject to taxation.

It wasn’t just teachers who got a mention. Labour activist David Osland said: “Rishi Sunak has just published his tax return. Turns out he pays a lower rate of tax on his £2.2m income than a ‘greedy’ train driver on £60k.”

The 23% tax figure was due to the majority of Rishi Sunak’s earnings being from capital gains, which are taxed at a lower rate than regular income.

The PM’s previous vocal support for reducing the top rate of capital gains tax from 28% to 20% in 2016 didn’t escape criticism, with the Trades Union Congress (TUC) tweeting the story with the wry comment: “It really is a mystery why Rishi Sunak raised income tax but not capital gains tax.”

Robert Palmer of Tax Justice UK, who campaign to build a fairer tax system, emphasised the urgent need to address the disparity in taxation between income from wealth and income from work.

Palmer tweeted: “At the moment someone who earns most of their money from their wealth – like the Prime Minister – pays a much lower tax rate than someone who relies on going out to work for their living.”

Others criticised the fact that, rather than providing a comprehensive tax return, Downing Street released a summary of Sunak’s UK taxable income and tax paid, raising further questions about transparency.

Sunak’s global financial footprint also came under scrutiny, with details of separate tax payments in the US adding to the complexity of his financial affairs.

The PM is married to Akshata Murty, whose family boasts a fortune of over £500 million, leading to accusations that he is out of touch with ordinary Britons grappling with the cost of living crisis.

Despite facing backlash, Sunak defended his wealth, attributing it to hard work and dismissing criticisms as political smears.

Sunak’s tax row follows a challenging week for the Prime Minister, where he faced fierce criticism for making a jibe about trans people during Prime Minister’s Questions whilst murdered trans teenager Brianna Ghey’s mother was in the chamber.

The prime minister cruelly joked in the House of Commons that Labour leader Kier Starmer had changed his position on “defining a woman”, accusing him of “breaking every single promise he was elected on.”

After standing to respond, a stoney-faced Starmer replied: “Of all the weeks to say that, when Brianna’s mother is in this chamber. Shame.”